Play the best casinos

Hoewel je je SingularityNET binnen handbereik hebt en deze snel kunt verhandelen, is niets zo onveilig als je SingularityNET op een exchange wallet laten staan. In wezen is het bewaren van je SingularityNET op een exchange wallet net als geld bewaren op de bank: je hebt digitaal recht op geld, namelijk de balans die speciaal aan jou is toegewezen op het platform of bij het bedrijf, de exchange in kwestie in dit geval. https://bpromanagement.com/casino/wildpharao-html/ Voor de rest heb je niets tastbaars zelf in je hand, als de exchange gehacked wordt of failliet gaat, ben je dus alles kwijt.

Er zijn veel verschillende SingularityNET wallets. Zo zijn er simpele SingularityNET wallet apps, maar ook SingularityNET hardware wallets. Er zijn eigenlijk drie soorten SingularityNET wallets waar je uit kunt kiezen:

Om deze raden wij aan enkel een bedrag aan Hivemapper te bewaren op een exchange wallet, waar je actief mee handelt. De rest van je Hivemapper holdings kan je veel beter op een hardware wallet opslaan, zodat je het zelf in handen hebt en zelf de verantwoordelijkheid over je Hivemapper draagt.

Deze SingularityNET wallet bewaart je private keys, de wachtwoorden die je toegang geven tot je SingularityNETportfolio. Er wordt onder SingularityNET wallets onderscheidt gemaakt tussen hot- en coldwallets, hardware-, software-, en exchangewallets. In dit artikel gaan we het hebben over wat nu welk soort SingularityNET wallet precies is

Best cryptocurrency

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

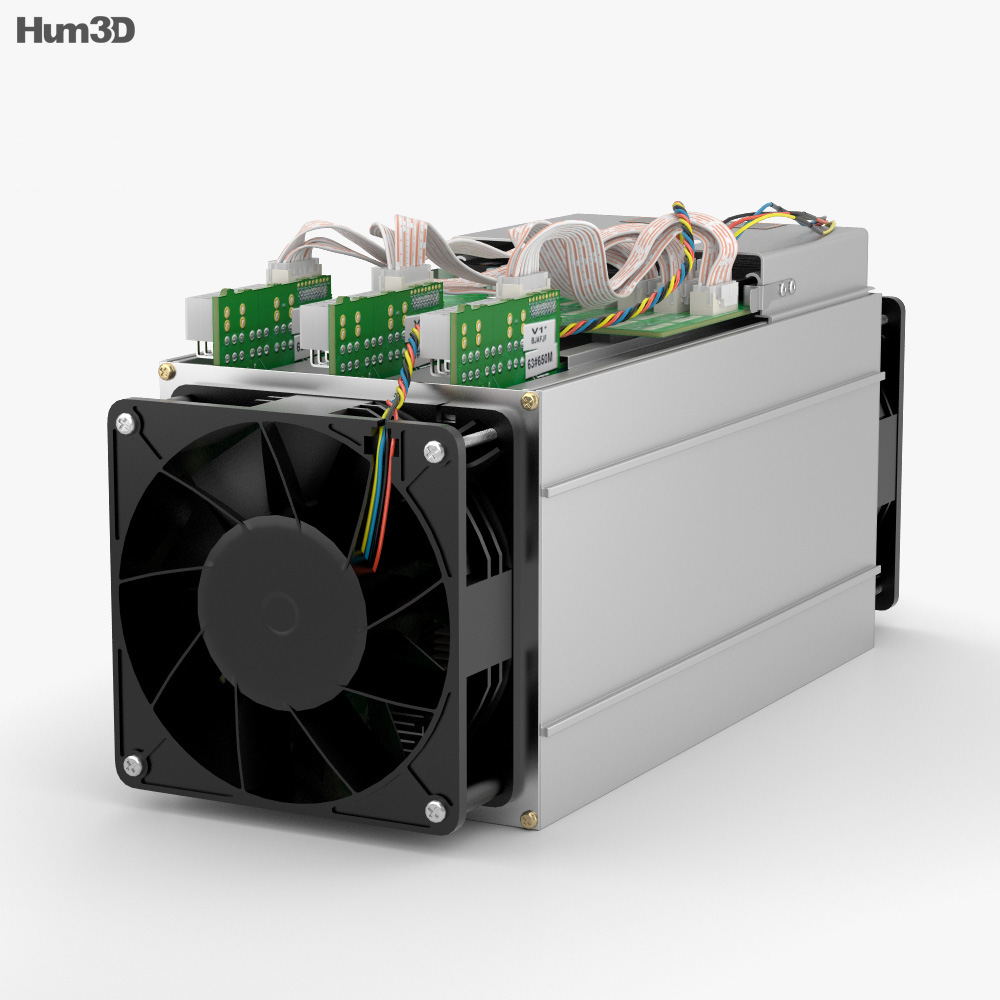

To create supply, bitcoin rewards crypto miners with a set bitcoin amount. To be exact, 6.25 BTC is issued when a miner has successfully mined a single block. To keep the process in check, the rewards given for mining bitcoin are cut in half almost every four years.

In the dynamic world of digital currencies, there are several promising cryptos that have caught the attention of enthusiasts and investors alike. One such crypto is known for its high-speed transactions and scalability. It’s often used in the gaming industry and has partnerships with several major companies in the tech industry.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

To create supply, bitcoin rewards crypto miners with a set bitcoin amount. To be exact, 6.25 BTC is issued when a miner has successfully mined a single block. To keep the process in check, the rewards given for mining bitcoin are cut in half almost every four years.

Elon musk cryptocurrency

Elon Musk is a prominent figure in the world of cryptocurrencies, known for his involvement and influence within the industry. As the CEO of Tesla and SpaceX, Musk has garnered significant attention for his interest and support of digital currencies like Bitcoin and Dogecoin. While his statements and actions have had a notable impact on the market, it is important to approach his involvement with a critical lens, considering the volatile nature of cryptocurrencies. Musk’s tweets and public endorsements have often led to significant price fluctuations, causing both excitement and concern among investors.

Tesla chief executive Elon Musk remains one of the bitcoin and crypto market’s most influential … voices, able to add millions of dollars in value to the price of cryptocurrencies like ethereum, XRP, solana and dogecoin.

Musk’s tweets, while not necessarily posted for his own financial gain, can greatly affect investors in cryptocurrency. They also raise questions about the solidity of a market that can be so easily swayed, especially as retail investors increasingly flock to cryptocurrencies. In April, the cryptocurrency exchange platform Coinbase became the first major cryptocurrency company to go public in the US, signifying the mainstreaming of blockchain-based currencies like bitcoin, ethereum, and dogecoin.

The huge crypto price surge has seen the combined bitcoin, ethereum, XRP, solana, dogecoin and crypto market rocket back toward its previous all time high of almost $3 trillion over the last year, sparking a wave of bullish predictions.